Financial Projection & Business Plan

Comprehensive Project Feasibility Assessment & Advanced Financial Consulting

When considering buying a business, launching a new venture, assessing your current operations, attracting investors, securing loans, or exploring partnership opportunities, strategic financial planning is crucial for sustainable growth and success. At Business Management Consultation Ltd, we specialize in thorough Project Feasibility Assessments and tailored financial consulting services using internationally recognized techniques. Our expertise ensures you can make sound, informed decisions and gain a competitive edge in your industry.

What We Offer:

- Payback Period (PBP) Analysis

- Definition: Calculates the time required to recover the initial investment from the cash inflows generated by the project.

- Purpose: Helps you determine the risk and time horizon for recouping investment, facilitating decisions about cash flow management and short-term feasibility.

- Method: We detail step-by-step how the cash inflows will accumulate over time and when they’ll match the initial cost of investment.

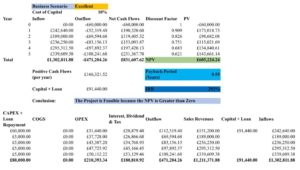

- Net Present Value (NPV) Analysis

- Definition: Measures the difference between the present value of cash inflows and outflows over a project’s lifetime.

- Purpose: Provides a clear indicator of whether an investment will generate a positive return. A positive NPV suggests profitability, while a negative one indicates potential loss.

- Application: We use accurate discount rates to provide a comprehensive financial summary and project evaluation.

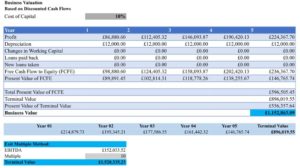

- Discounted Cash Flow (DCF) Analysis

- Definition: Evaluates the value of an investment by considering its future cash flows and discounting them back to present value.

- Purpose: Helps project future profitability, taking the time value of money into account to estimate the real value of the business or project.

- Approach: Our team analyzes projected revenue and expense streams to forecast profitability and potential investment returns.

- Financial Reporting (FR)

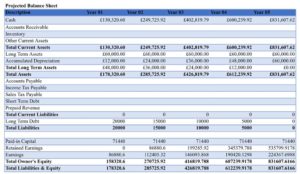

- Definition: Detailed reports outlining your financial health, including balance sheets, income statements, and cash flow statements.

- Purpose: Ensures transparency in financial performance, aiding stakeholders in understanding business stability and viability.

- Benefits: Our financial reports are tailored for decision-makers, showing insights into profitability, liquidity, and long-term sustainability.

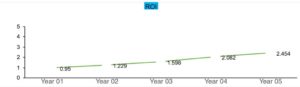

- Return on Investment (ROI) Analysis

- Definition: Calculates the percentage return on an investment relative to its cost.

- Purpose: Measures the efficiency of an investment and aids in comparing different options for better resource allocation.

- Execution: We include historical data and project-specific projections to forecast ROI trends, allowing you to visualize potential returns over time.

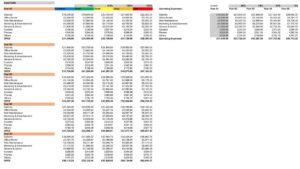

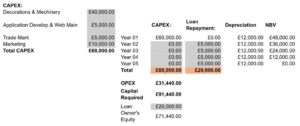

- Capital Expenditure (CapEx) & Operational Expenditure (OpEx) Analysis

- Definition: CapEx refers to the initial costs required to start the business, while OpEx involves ongoing operational expenses.

- Purpose: Helps you evaluate whether your funding covers initial setup costs and long-term operational needs, and how these costs impact profitability.

- Details Provided:

- CapEx: Costs for equipment, property, technology, and other one-time investments.

- OpEx: Salaries, rent, utilities, marketing expenses, and other day-to-day operational costs.

Additional Services Offered:

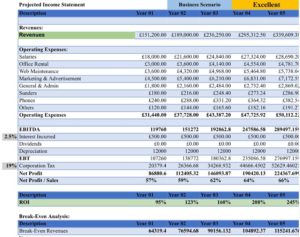

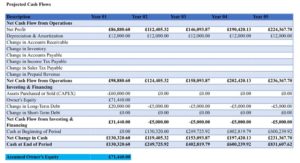

Financial Modelling & Projections

- Comprehensive financial models to evaluate potential outcomes and assist in future decision-making.

- We create detailed projections, including income statements, balance sheets, and cash flow statements, tailored for startup scenarios and established businesses.

Budgeting & Forecasting

- Preparation of detailed budgets that align with strategic goals, allowing businesses to anticipate financial needs and allocate resources efficiently.

- Forecasting services to assess long-term financial trends, ensure you remain on track, and make necessary adjustments proactively.

Break-even Analysis

- In-depth analysis to determine when your business will start generating a profit by identifying the revenue required to cover costs.

- Visualization tools like graphs and charts to make it easy for you to see and understand your financial position.

Sensitivity Analysis

- Dynamic tools that help you understand how various business scenarios (e.g., cost increases, sales fluctuations) impact your financial metrics.

- Interactive drop-down menus in our models allow you to test different conditions and observe the outcome on financial health and projections.

Business Valuations

- Comprehensive valuations using Discounted Cash Flow (DCF) and other industry-standard methods.

- Services include creating detailed reports with potential investment values, assisting with mergers, acquisitions, or sale negotiations.

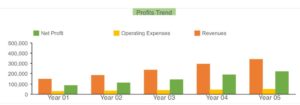

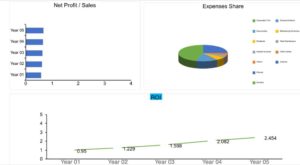

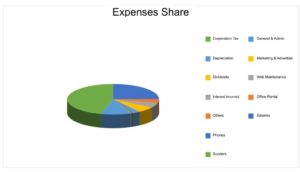

Visual Representation of Data

We enhance our financial models with various data visualizations, including:

- Profit Trend Graphs: Illustrate profit growth over time.

- Pie Charts: Showcase revenue shares and expenditure distributions for better clarity.

- Financial Ratio Analysis: Include essential metrics like Gross Profit Margin (GP), Net Profit Margin (NP), ROI, and trend graphs spanning multiple years.

Applications of Our Services:

Our expertise supports various business purposes, including:

- Investor Roadshows: Provide potential investors with detailed, professional financial plans and projections.

- Loan Approval: Prepare comprehensive business plans and financial reports that appeal to lenders and meet their due diligence requirements.

- Partnerships/Joint Ventures: Equip you with the data needed to negotiate and establish mutually beneficial agreements.

- Personal Use: Tailor financial projections and feasibility assessments for individual use, whether starting a side business or personal investments.

Industries We Serve:

Our services extend to a wide range of industries:

- Internet & Technology

- Bars & Restaurants

- Healthcare & Hospitals

- Health & Fitness

- Education

- Agriculture

- Trading

- Freelancing Platforms

- Transportation (Uber & Careem Model)

- Commercial & Household Cleaning Services

- Childcare Centers & Services

- Non-Governmental Organizations (NGOs)

What We Need From You:

To craft the most accurate and customized service package, we ask for the following information:

- Product Categories and Pricing

- Gross Profit Margin (%)

- Initial Setup Costs

- Detailed List of Operational Expenses, including:

- Salaries and Wages

- Rent and Property Costs

- Utility Expenses

- Website and IT Maintenance

- Fuel and Vehicle Expenses

- Phone & Internet Costs

- Marketing and Advertising Budgets

- General Administration Expenses

- Repair and Maintenance Costs

- Cost of Capital (Interest Rate)

Our Commitment to You:

At Business Management Consultation Ltd, we prioritize delivering high-quality, efficient, and impactful financial consulting services. We’re dedicated to empowering entrepreneurs and business owners to navigate financial decisions confidently and achieve sustainable growth.

Contact us today to learn more about how we can help you plan for success and build a strong foundation for your business.

Profit Trend

OPEX & Revenue

NPV & CAPEX

DCF & ROI

Graphs & Charts

Projected Income Statements & Cash Flow

Projected Balance Sheet